Ethereum is showing a strong bullish trend, consolidating above the 100-day and 200-day moving averages. With the recent introduction of spot ETH ETFs, there’s potential for Ethereum to target $4,000 in the near term.

Technical Analysis

Daily Chart Overview

On the daily chart, Ethereum has recently broken above the crucial 100-day moving average at $3,354, leading to a phase of sideways movement. This consolidation reflects a balance between buying and selling forces. However, with the launch of spot ETH ETFs, which attracted $106.6 million on their first day, increased buying interest is expected. This development could drive the price towards the wedge’s upper boundary at $3,700.

At present, Ethereum’s price is constrained within a critical range, with $3,700 acting as the upper resistance and $3,400 serving as key support. Given the current bullish outlook, a move towards a breakout seems more likely.

4-Hour Chart Insights

The 4-hour chart shows that Ethereum has struggled to exceed the significant swing high of $3,500 due to ongoing selling pressure, resulting in a consolidation phase. During this time, an ascending wedge pattern has emerged. While this pattern typically suggests a bearish reversal, the overall market sentiment remains bullish, potentially leading to a breakout above the wedge. If a bearish scenario unfolds, a short-term price pullback could provide an opportunity for investors to acquire ETH at lower prices.

On-Chain Metrics

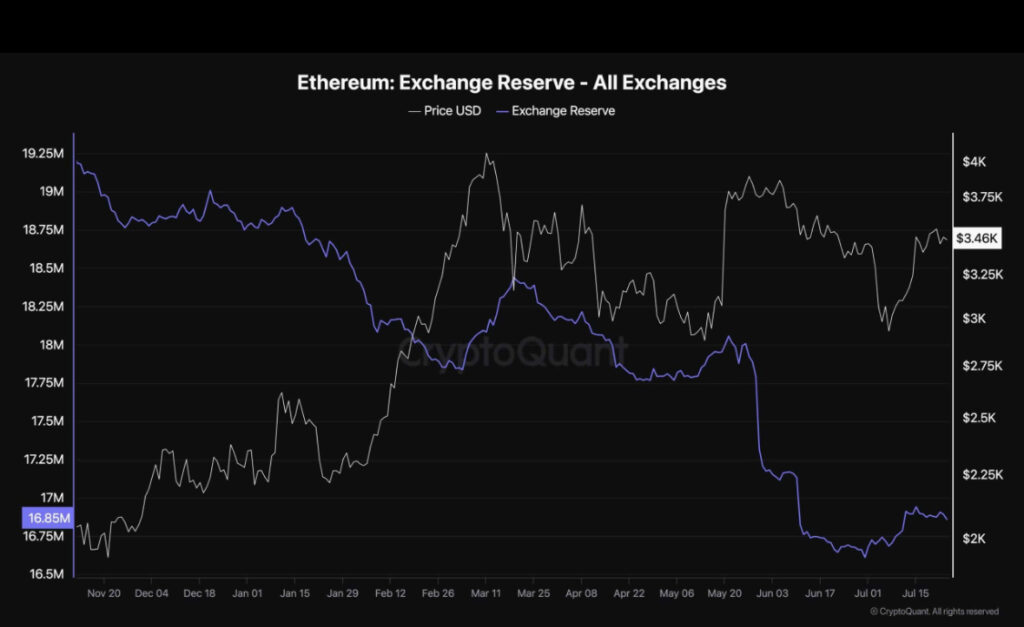

As Ethereum’s price recovers from below $3,000 and with the new ETH Spot ETFs in play, on-chain analysis offers valuable insights. The Ethereum Exchange Reserve metric, which tracks ETH held in exchange wallets, indicates a decline. A decreasing reserve typically suggests that investors are withdrawing their ETH from exchanges for long-term holding, rather than selling.

Recent data shows a significant drop in exchange reserves following the anticipated Spot ETFs launch in July. This trend implies that major investors have seized the opportunity to buy ETH during recent dips and are now holding their assets off exchanges. This reduction in available supply, coupled with rising buying interest from the ETFs, could pave the way for a continued rally in the coming months.