The cryptocurrency market endured a rough start to the week as Bitcoin (BTC) plunged below $100,000, erasing gains from the weekend. This sudden downturn led to mass liquidations, with nearly 228,000 traders affected, including one who lost a staggering $100 million in a single trade.

Bitcoin’s Sharp Decline

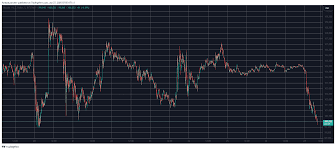

After spending the weekend trading steadily around $105,000, Bitcoin took a significant hit during Monday’s Asian trading session. The cryptocurrency dropped 5% in just a few hours, reaching a weekly low of $99,700. This decline also pushed Bitcoin’s market capitalization below the crucial $2 trillion mark, intensifying concerns among traders.

Altcoins Face Steeper Losses

While Bitcoin’s drop was notable, altcoins suffered even greater losses. Ethereum (ETH), which had recently approached $3,400, fell by 7% in a single day to $3,100.

Other leading cryptocurrencies also experienced sharp declines:

• XRP dipped below $3 for the first time in weeks.

• BNB dropped to $650.

• Cardano (ADA) fell to $0.90.

• Chainlink (LINK) slid to $23.

Smaller altcoins, including Solana (SOL), Dogecoin (DOGE), and Shiba Inu (SHIB), posted double-digit losses. Tokens like PEPE, HBAR, and APT also suffered significant declines as the sell-off spread across the market.

$600 Million Liquidated in One Day

The market’s volatility resulted in over $600 million in liquidations over the past 24 hours, according to CoinGlass. More than $560 million of those liquidations occurred in just 12 hours. Nearly 230,000 traders were affected, with the largest liquidation involving a $98.46 million BTC/USDT trade on the HTX exchange.

What’s Next for the Market?

This sharp correction is a reminder of the extreme volatility in cryptocurrency markets, even as Bitcoin remains significantly above its long-term historical averages. With major altcoins also under pressure, market participants are keeping a close watch on whether Bitcoin can reclaim the $100,000 level or if further declines are imminent.

As the market adjusts, traders and investors are bracing for more potential turbulence in the days ahead.